Legacy Giving

Shape the Future. Transform Lives.

At Schulich, we shape futures, transform lives, and we embrace global innovation and diversity. As one of the world’s premier business schools, our commitment to excellence is only matched by the generosity of our visionary supporters.

Leaving a legacy gift to Schulich is more than a gesture – it is a profound investment in the leaders and innovators of tomorrow. By entrusting Schulich with your legacy, you empower Schulich to address the evolving needs of our students and allocate resources where we can create the most impact.

Why a Legacy Gift Becomes Part of your Life Story

Invest in Schulich’s future sustainability by empowering Schulich with an unrestricted gift, ensuring that resources are allocated where they can make the greatest impact.

Support vital initiatives across student support, faculty research, student experience, and facilities.

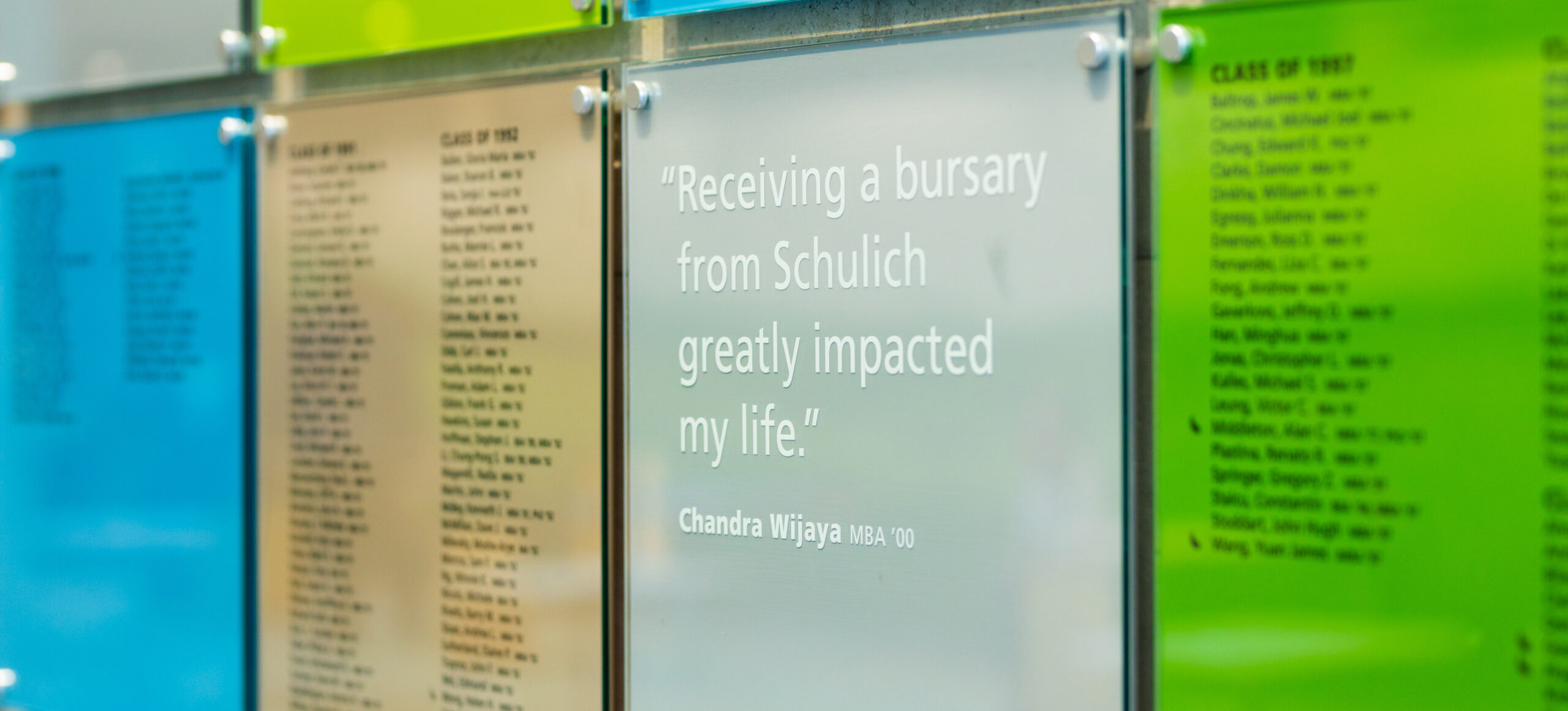

Your Legacy. Your Stories.

Ways to Give

There are many ways you can support Schulich and future business leaders. Please contact our Office at advancement@schulich.yorku.ca if you require more information or need assistance.

Including a gift in your will is a powerful way to make a lasting impact, align your financial and philanthropic goals, and ensure that your legacy reflects your values and priorities.

By utilizing charitable tax receipts, your bequest becomes a powerful estate planning tool, allowing you to allocate up to 100% of your net income towards your donation while reducing the tax burden on your estate.

It has no effect on your cash flow during your lifetime providing you financial stability.

Enjoy the flexibility and tailored designation to specify a fixed dollar amount or percentage, and even designate Schulich as a contingent beneficiary, ensuring your intentions are honoured.

You have diverse giving options that can take various forms, ranging from cash to marketable securities, stock, real estate, or tangible personal property like artwork or book collections, allowing you to align your donation with your assets.

Have the peace of mind that your estate is organized, and your heirs are prioritized, providing you with financial comfort amidst your philanthropic endeavours.

Leaving a legacy of excellence in education can be as simple as including a line such as the following in your will: “I give and bequeath [the sum of $__ OR __% OR the residue of my estate] to the Schulich School of Business, York University, 4700 Keele Street, Toronto, Ontario M3J 1P3 Canada, Charitable Registration #: 11930 6736 RR0001.”

Charitable gifts of RRSPs, RRIFs, and TFSAs can eliminate or greatly reduce deferred tax burdens. Designating Schulich as a beneficiary is straightforward. Contact your plan administrator for a “designation of beneficiary form” or “multiple beneficiary designation form.”

Gifts of RRSPs, RRIFs, and TFSAs often result in an increased donation impact than possible during a lifetime.

You have the flexibility to allocate the entire amount or specify a portion, and even name Schulich as a contingent beneficiary.

You retain complete access to the funds during your lifetime.

The charitable gift provides tax advantages generating tax credits to offset estate administration tax payable to the Canada Revenue Agency (CRA).

Quick and straightforward, offering privacy and minimal risk of contestation by heirs or family members.

Including life insurance in your charitable giving strategy can provide cost-effective ways to support causes you care about, maximize tax benefits, and simplify your estate planning process. It offers flexibility, privacy, and ease of setup, making it an attractive option for donors looking to leave a lasting legacy.

Life insurance donations offer highly cost-effective giving options, potentially allowing for a larger overall contribution compared to other methods.

Immediate tax relief against your current tax return (for options involving transfer or purchase of policies), or deferred tax benefits for your estate upon passing (for beneficiary designation).

Sidestep estate administration tax by transferring outside your estate, commonly known as probate fees.

Quick and straightforward setup, offering privacy and minimal risk of contestation by heirs or family members.

Including stocks and securities in your charitable giving strategy can provide tax-efficient ways to support causes you care about, maximize the impact of your donation, and offer flexibility in how you choose to give.

When you sell a publicly traded security, you typically face income tax on 50% of the capital gain. However, by opting to donate appreciated investments, you avoid capital gains taxes entirely.

Gifts of stocks and securities often result in an increased donation impact without increasing your net cost.

When you make your donation, you will receive a tax receipt for the full fair market value of the securities on the day they are received, offering additional tax benefits.

You have the flexibility to donate a portion of your stock while retaining the remainder for personal use today or as part of your estate planning.

Annuities allow you to make an immediate gift to support your charitable cause while receiving a guarantee predetermined income for life for you and your surviving partner.

Your gift is divided into two parts. A portion of your gift is immediately given to the charitable organization, and you receive a tax receipt for that amount. The remainder is used to purchase an annuity from an insurance company, and you will receive a guaranteed income for life.

You receive a fixed and guaranteed income stream, at a rate of return that is typically higher than the rate of guaranteed income investments.

Depending on your age, a substantial portion or all your annuity income payments may be tax-free.

You will receive a charitable tax receipt for the gift component or even more tax savings.

How You Benefit from Making a Legacy Gift

- It aligns with your values, ensuring a lasting impact that continues to shape lives.

- You can leverage charitable tax receipts to reduce the tax burden on your estate.

- Maintain control of your assets during your lifetime, providing financial stability.

- Ensure your estate is organized, with your philanthropic priorities honoured and your heirs supported.

Your Membership to the Dean’s Society

The Dean’s Society is a prestigious community of global leaders and philanthropists who share a passion for investing in the vision and future of the Schulich School of Business. Your commitment to support Schulich through your legacy gift enrolls you in the Dean’s Society as a White Rose member. To learn more, click here.

Connect With Our Advancement Team Today

Be part of investing in the future by speaking to us about your philanthropic plans. Whether you are interested in designating your gift to a greatest need area or exploring recognition opportunities, we are here to help you every step of the way. Contact us today advancement@schulich.yorku.ca to start the journey towards creating a legacy that transforms lives.

For Financial Advisers

Legal name: York University

Charitable registration no.: 119306736RR0001CRA

Address: 4700 Keele St., West Office Building, Toronto, ON, M3J 1P3

Undesignated:

“My trustees shall deliver, pay or transfer a specific amount or a portion of the residue of my estate to Schulich School of Business, York University.”

Designated:

“My trustees shall deliver, pay or transfer a specific amount or a portion of the residue of my estate to Schulich School of Business, York University, to be used for area of interest. In the event that circumstances make the specific use of this gift no longer practical or desirable, the University is hereby authorized to make changes in its use consonant with the spirit and general intent of the gift.”

If your client wishes to designate their gift to a specific area within the School, please contact us for detailed Will language.

Let us thank you.

If your client has included a legacy gift to Schulich and is willing to let us know, kindly have them contact Ana Santos (437) 335-3156 or email advancement@schulich.yorku.ca, so we may thank you and welcome them as a White Rose member of the Dean’s Society.